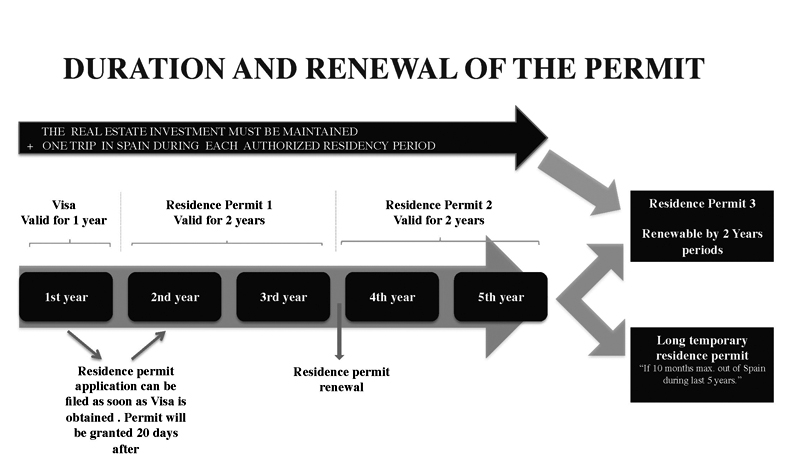

TWO-YEAR RENEWABLE RESIDENCE PERMIT:

Some additional requirements are needed in order to obtain this permit. The investor should:

Hold an investors’ visa.

Have travelled to Spain at least once during this period.

Still own a real estate for the value of at least 500,000 Euros or maintain an investment of the same or higher value.

DURATION AND RENEWAL OF THE RESIDENCE PERMIT

- The family members who can benefit from this residence permit are:

- The spouse.

- The children or the children of the spouse who are under the age of 18 years (children with disabilities are not restricted to the age of 18).

- The ward legally represented by the sponsor, providing to be under 18 years or disabled.

- All family residence permits expire upon expiry of the sponsor’s residence permit.

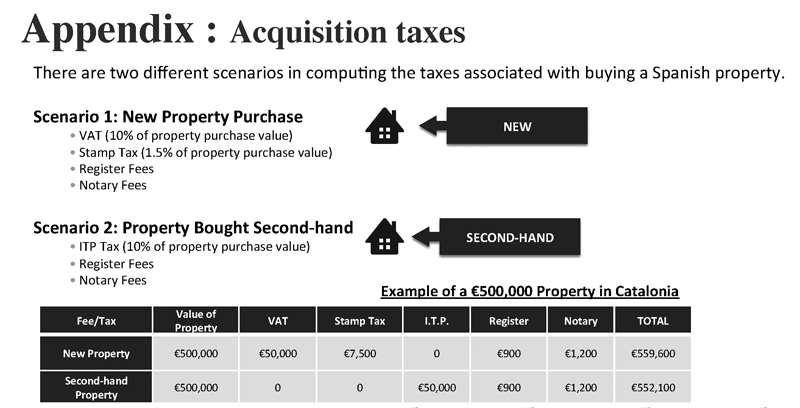

- Appendix: Acquisition taxes

- Taxes associated with buying a Spanish property are calculated in two ways:

- New Property Purchase

- VAT (10% of property purchase value)

- Stamp Tax (1.5% of property purchase value)

- Register Fees

- Notary Fees

- Second Hand Property

- ITP Tax (10% of property purchase value)

- Register Fees

- Notary Fees